Navigating the Future: Emerging Trends in Fintech Technology

Fintech Technology

Fintech technology is revolutionizing the financial industry, and it’s essential to stay ahead of the curve. Navigating the future of fintech requires a deep understanding of emerging trends and technologies. In this article, we’ll explore the latest developments in fintech and their potential impact on the industry.

Emerging Trends in Fintech

Several emerging trends are shaping the future of fintech, including artificial intelligence, blockchain, and the Internet of Things (IoT). These technologies are enabling new business models, improving efficiency, and enhancing customer experiences. For instance, AI-powered chatbots are being used to provide personalized customer support, while blockchain is being used to secure transactions and protect sensitive data.

Impact of Fintech on Traditional Banking

The rise of fintech is disrupting traditional banking models, and banks are being forced to adapt to stay competitive. Fintech companies are offering innovative services, such as mobile payments, peer-to-peer lending, and robo-advisory services, which are attracting a new generation of customers. Traditional banks are responding by investing in digital transformation, partnering with fintech companies, and developing their own innovative services.

Future of Fintech

As fintech continues to evolve, we can expect to see even more innovative technologies and business models emerge. The use of machine learning, natural language processing, and computer vision will become more prevalent, enabling fintech companies to provide more personalized and efficient services. Additionally, the growth of fintech will create new opportunities for entrepreneurship, job creation, and economic growth.

Conclusion

In conclusion, navigating the future of fintech requires a deep understanding of emerging trends and technologies. As the industry continues to evolve, it’s essential to stay ahead of the curve and be prepared to adapt to new developments. By understanding the latest trends and technologies, businesses and individuals can position themselves for success in the rapidly changing fintech landscape.

Benefits of Fintech

The benefits of fintech are numerous, and they include improved efficiency, reduced costs, and enhanced customer experiences. Fintech companies are using technology to streamline processes, reduce manual errors, and provide 24/7 services. Additionally, fintech is enabling financial inclusion, providing access to financial services for underserved populations and promoting economic growth.

Challenges Facing Fintech

Despite the many benefits of fintech, there are also challenges facing the industry. These challenges include regulatory uncertainty, cybersecurity risks, and the need for greater collaboration between fintech companies, traditional banks, and governments. To overcome these challenges, it’s essential to establish clear regulations, invest in cybersecurity measures, and promote collaboration and innovation.

Real-World Applications of Fintech

Fintech has many real-world applications, and they include mobile payments, peer-to-peer lending, and robo-advisory services. For instance, mobile payments are enabling people to make transactions using their smartphones, while peer-to-peer lending is providing access to credit for individuals and small businesses. Robo-advisory services are providing low-cost investment advice, making it possible for people to manage their investments more effectively.

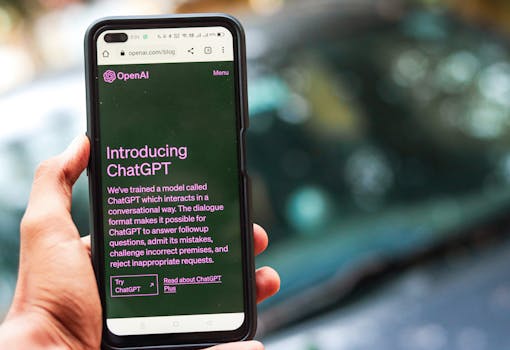

Role of Artificial Intelligence in Fintech

Artificial intelligence (AI) is playing a significant role in fintech, and it’s being used to improve customer experiences, detect fraud, and provide personalized services. AI-powered chatbots are being used to provide 24/7 customer support, while machine learning algorithms are being used to detect anomalies and prevent fraud. Additionally, AI is being used to provide personalized investment advice, making it possible for people to make more informed investment decisions.

Blockchain in Fintech

Blockchain is a distributed ledger technology that’s being used in fintech to secure transactions and protect sensitive data. It’s being used to enable cross-border payments, facilitate trade finance, and provide identity verification services. Additionally, blockchain is being used to create smart contracts, which are self-executing contracts with the terms of the agreement written directly into lines of code.

Internet of Things (IoT) in Fintech

The Internet of Things (IoT) is a network of physical devices, vehicles, and other items that are embedded with sensors, software, and connectivity, allowing them to collect and exchange data. In fintech, IoT is being used to enable contactless payments, track transactions, and provide personalized services. For instance, IoT devices are being used to enable contactless payments, making it possible for people to make transactions without the need for cash or cards.

Security in Fintech

Security is a critical aspect of fintech, and it’s essential to ensure that sensitive data is protected from cyber threats. Fintech companies are using various security measures, including encryption, firewalls, and intrusion detection systems, to protect their systems and data. Additionally, fintech companies are investing in cybersecurity awareness training, making it possible for employees to identify and respond to cyber threats more effectively.

Regulatory Environment for Fintech

The regulatory environment for fintech is evolving, and it’s essential to stay up-to-date with the latest developments. Regulators are working to establish clear guidelines and regulations for fintech companies, making it possible for them to operate more effectively. Additionally, regulators are promoting innovation, making it possible for fintech companies to develop new products and services.

Future Outlook for Fintech

The future outlook for fintech is promising, and it’s expected to continue growing in the coming years. As technology continues to evolve, we can expect to see even more innovative products and services emerge. The growth of fintech will create new opportunities for entrepreneurship, job creation, and economic growth, making it an exciting time for the industry.