Ever wanted to make money from investing in something you love? Whether you’re looking to profit from your hobby or collection, or you’re a serious investor seeking to diversify your portfolio, ‘The Ultimate Guide to Investing in Collectibles’ contains all you need to know. This comprehensive guide covers a range of subjects that will help you build a structured approach to your collection and make informed investment decisions.

Key Takeaways

- Understanding the value of collectibles involves factors like market trends, historical significance, and individual appeal.

- Starting your investment journey requires choosing a niche, setting a budget, and thoroughly researching the market.

- Buying and selling collectibles can be done through reputable dealers, auctions, and private sales, each with its own set of considerations.

- Legal and tax implications, including insurance and legal protections, are crucial aspects of investing in collectibles.

- Detecting fakes and forgeries is essential, and involves recognizing common red flags, using authentication methods, and consulting experts.

Understanding the Value of Collectibles

Factors Influencing Value

The only way to determine value is by finding out how much someone else is willing to pay for it. An object’s desirability is one factor that affects value, rarity is another. Collectibles at every value range have unique factors that influence their worth. Age is not a determining factor itself — not all “old” things are collectible or valuable.

Market Trends

Market trends play a crucial role in the value of collectibles. The degree to which these concerns factor in also depends on what area of the collectible spectrum is involved and how much money will be committed. Collectibles are far less liquid than traditional securities, making them a considered purchase.

Historical Significance

Historical significance can greatly enhance the value of a collectible. Items that are out of production, or those produced in limited quantity, have the potential to become “collectible.” However, it’s important to temper expectations of a reasonable return on investment. The market decides; an antique is collectible when other people think it’s collectible.

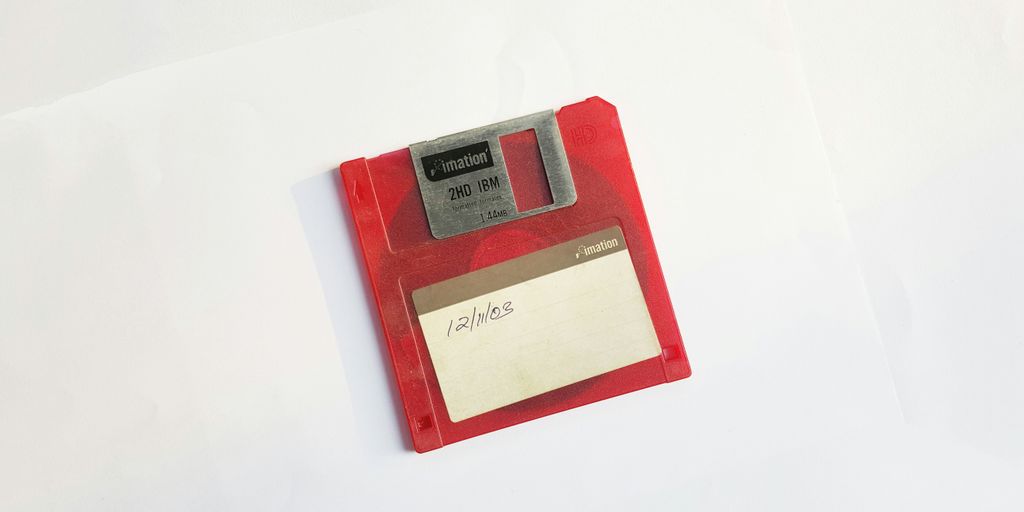

It’s possible for anything to be an investment if it appreciates in value over time, including vintage cars, baseball cards, fine art, fine wine, and more recently, digital assets called NFTs.

How to Start Investing in Collectibles

Choosing Your Niche

Ever wanted to make money from investing in something you love? Start by choosing a niche that genuinely interests you. Whether it’s vintage toys, rare coins, or fine art, your passion will drive your success.

- Research different categories

- Assess market demand

- Consider long-term value

Your niche should align with your personal interests and market trends to maximize potential returns.

Setting a Budget

Before diving in, set a realistic budget. Don’t invest more than you can afford to lose. This will help you manage risks and avoid financial strain.

- Determine your initial investment amount

- Allocate funds for ongoing expenses

- Plan for potential losses

Researching the Market

Thorough research is crucial. Understand the influence of emerging technology on luxury living in Dubai. Blockchain and cryptocurrency redefine investments. Social media key for lifestyle branding in the city.

- Study market trends

- Follow industry news

- Join collector communities

Knowledge is power. The more you know, the better your investment decisions will be.

Buying and Selling Collectibles

Finding Reputable Dealers

When investing in collectibles, it’s crucial to work with reputable dealers. They have the expertise to guide you through the market and help you avoid common pitfalls. Look for dealers with a strong track record and positive reviews.

- Verify their credentials

- Check for memberships in professional organizations

- Ask for references from other collectors

Building a relationship with a trusted dealer can significantly enhance your investment journey.

Navigating Auctions

Auctions can be an exciting way to acquire unique items. However, they come with their own set of challenges. Understanding the auction process is key to making informed decisions.

- Research the auction house

- Understand the bidding process

- Set a maximum bid to avoid overspending

Private Sales

Private sales offer a more discreet way to buy and sell collectibles. This method can often lead to better deals and more personalized service. However, it’s essential to ensure that all transactions are transparent and well-documented.

- Negotiate terms clearly

- Use contracts to formalize agreements

- Consider legal advice for high-value items

Private sales can be a great way to find rare items that aren’t available through traditional channels.

Legal and Tax Considerations

Tax Implications

When investing in collectibles, it’s crucial to understand the tax implications. Collectibles are subject to a maximum tax rate of 28%, which is higher than the top rate for securities. If you sell any items for a long-term capital gain, be prepared for this higher tax rate. Additionally, the IRS may assess capital gains tax when you sell the collectible.

Always consult your financial professional to understand the impact such investing may have on your budget and estate planning.

Legal Protections

Investing in collectibles requires awareness of legal protections. Ensure you have proper documentation and provenance for each item. This not only helps in establishing authenticity but also in protecting your investment legally. Work with reputable dealers and consult experts in the collectible area you are contemplating.

Insurance

Insurance is a key consideration for collectible investments. High-value items should be insured to protect against theft, damage, or loss. Consult with insurance providers who specialize in collectibles to get the best coverage. Don’t invest more than you can afford to lose if the investment doesn’t perform as expected.

Detecting Fakes and Forgeries

Common Red Flags

When investing in collectibles, identifying fakes and forgeries is crucial. Look for inconsistencies in craftsmanship, unusual materials, and signs of artificial aging. Be wary of deals that seem too good to be true.

Authentication Methods

- Examine markings and signatures: Many antiques and collectibles have specific markings, stamps, or signatures that can help verify their authenticity.

- Use professional grading services: These services provide a detailed analysis of the item’s condition and authenticity.

- Compare with verified items: Use art archives and databases to compare your item with authenticated pieces.

Expert Consultations

Consulting with experts can save you from costly mistakes. They can provide insights into the item’s history and determine the authenticity of an antique or collectible. Always seek a second opinion if in doubt.

Investing in expert consultations can be a small price to pay compared to the potential loss from purchasing a fake.

Maximizing Profit from Your Collection

Timing the Market

Timing is everything when it comes to maximizing profit from your collectibles. Keep an eye on market trends and sell when demand is high. This can significantly boost your returns.

Restoration and Preservation

Proper restoration and preservation can greatly enhance the value of your collectibles. Use professional services to ensure your items are in the best possible condition.

Investing in restoration can turn a good profit into a great one.

Leveraging Online Platforms

Online platforms offer a vast marketplace for buying and selling collectibles. Utilize these platforms to reach a broader audience and achieve better prices.

- eBay

- Heritage Auctions

- Fractional ownership platforms

By leveraging these tools, you can confidently invest in collectible investments which were once unobtainable.

Diversifying Your Investment Portfolio with Collectibles

Diversification is key to managing risk in any investment portfolio. While collectibles can be a fun addition to any portfolio, they should only make up a small portion. This helps to offset the risk associated with any individual investment.

In a diversified portfolio, each asset class contributes to your overall returns. By including collectibles, you can enhance your stock market performance and add a unique asset class to your investments.

Collectibles as an investment: where fun meets finance. They offer a unique way to diversify and potentially increase your returns.

When investing in collectibles, consider your investment horizon. Some collectibles may offer quick returns, while others are better suited for long-term gains. Always consult with experts to understand the market trends and potential returns.

Conclusion

Investing in collectibles offers a unique blend of passion and profit potential. Whether you’re a hobbyist looking to monetize your collection or a serious investor aiming to diversify your portfolio, this ultimate guide provides all the essential insights and strategies you need. From understanding market trends and detecting fakes to navigating the complexities of buying, selling, and tax implications, this guide equips you with the knowledge to make informed decisions. Remember, while the world of collectibles can be rewarding, it’s crucial to approach it with a well-researched and structured strategy. Happy collecting and investing!

Frequently Asked Questions

What are the key factors influencing the value of collectibles?

The value of collectibles is influenced by factors such as rarity, condition, historical significance, market trends, and demand among collectors.

How do I choose a niche for investing in collectibles?

Choosing a niche involves researching various categories of collectibles, considering your personal interests, and evaluating the potential for value appreciation in that niche.

What are the tax implications of investing in collectibles?

Investing in collectibles can have tax implications, including capital gains tax when you sell an item at a profit. It is advisable to consult with a tax professional to understand the specific tax obligations in your jurisdiction.

How can I detect fakes and forgeries in the collectibles market?

Detecting fakes and forgeries involves looking for common red flags, using authentication methods, and consulting with experts who specialize in the specific type of collectible you are interested in.

What should I consider when buying collectibles from dealers or at auctions?

When buying from dealers or at auctions, consider the reputation of the dealer or auction house, verify the authenticity of the items, and be aware of the market value to avoid overpaying.

How can I maximize profit from my collectible investments?

Maximizing profit can be achieved by timing the market, ensuring proper restoration and preservation of items, and leveraging online platforms to reach a wider audience for selling your collectibles.