The Rise of AI in Bitcoin Mining

Bitcoin miners are experiencing a breakthrough moment as they pivot towards artificial intelligence (AI), leveraging their data centers for unprecedented opportunities. Leading companies in the mining industry, such as Hive Digital Technologies and TeraWulf, are turning their Bitcoin-focused infrastructure into AI-ready, profit-generating hubs. The conversion from Bitcoin mining data centers to AI data centers is accelerating, reducing setup times from years to merely months. This shift positions miners at the forefront of innovation and financial gains.

Bitcoin Miners: The Intersection of Crypto and AI

Historically, Bitcoin miners have been essential in the crypto ecosystem, producing rewarding returns for early investors. Now, their existing infrastructure offers a competitive advantage for AI development. “If you already have the infrastructure built from Bitcoin mining, it’s nine months to improve the data center,” said Frank Holmes, Executive Chairman of Hive Digital Technologies. Hive, considered a pioneer in this space, combines renewable-powered Bitcoin mining with advancing AI capabilities. Its market cap exceeds $600 million, and analysts are forecasting aggressive growth with targets of $6 to $12 per share (up from a current $3).

The Growing Institutional Interest

Institutional investors are beginning to notice the potential. Citadel Securities recently acquired a 5.4% stake in Hive, while TeraWulf landed a $3.2 billion deal with tech giant Alphabet (Google’s parent company). Notable figures like Kevin O’Leary, also known as ‘Mr. Wonderful’ from Shark Tank, have expressed similar enthusiasm. O’Leary has invested in Bitcoin mining companies like Bitzero, drawn by their dual focus on renewable energy and AI innovation.

AI’s Financial Potential for Bitcoin Miners

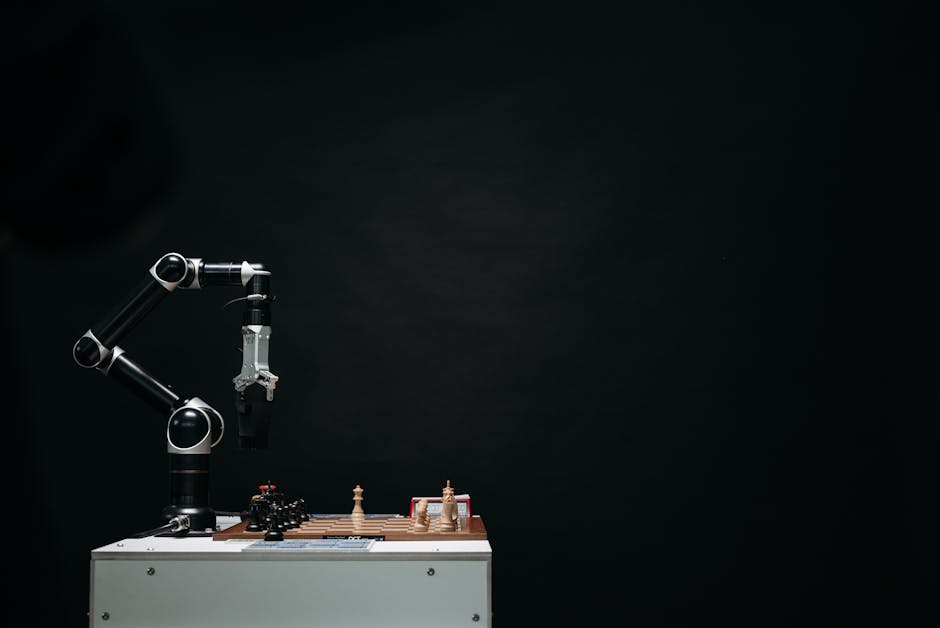

The potential applications for AI-driven data centers are vast, extending beyond tech companies to governments and militaries utilizing autonomous drones and intelligent machines. This demand will likely spur considerable growth in the sector. According to Holmes, “More money is going to AI. If you are going to have all of these drones, you’re going to need data centers and satellites. The intersection is going to be sovereign data centers.” The future could see Bitcoin miners transitioning from undervalued assets to cornerstone players in the AI and data economy.

Are There Investment Opportunities?

For those interested in exploring this growing sector, Hive Digital Technologies stands out as a promising option, offering both Bitcoin exposure and AI upside. You can check out their stock and market performance by visiting Hive Digital Technologies.

Conclusion: A Generational Opportunity

As Bitcoin mining companies reimagine their role in a burgeoning AI era, investors could see significant upside potential. Stocks like Hive, TeraWulf, and Cipher Mining have already demonstrated promising trajectories, and many believe there’s much more room for growth. Whether you’re an investor or a tech enthusiast, this convergence of Bitcoin mining and AI innovation represents a transformative moment in both industries.